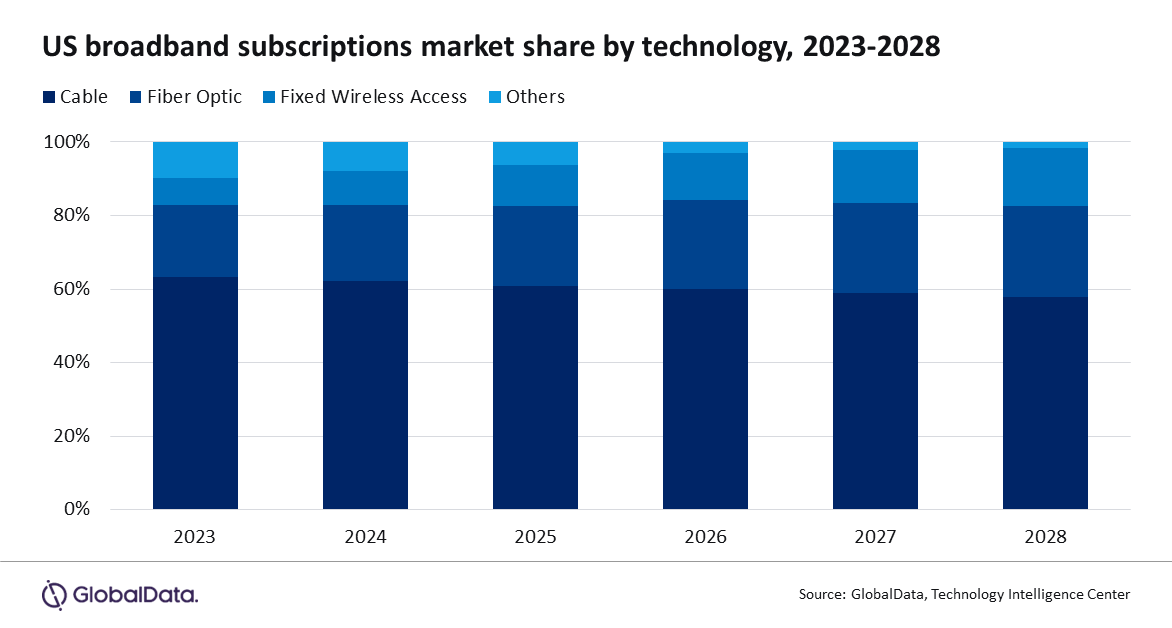

Fixed wireless access (FWA) technology for broadband internet continues to attract new users and is expected to more than double its subscription market share among US fixed broadband technologies, expanding from a 7.2% share in 2023 to 15.8% in 2028, according to GlobalData, a leading data and analytics company.

GlobalData’s updated report, “United States Fixed Communications Forecast,” reveals that despite its rapid adoption, FWA will remain ranked in third place behind cable and fiber subscriptions.

Tammy Parker, Principal Analyst at GlobalData, comments:

“Easy self- installation and affordability, combined with high reliability and performance, thanks to underlying 5G technology, are among FWA’s selling points, but so is the fact that FWA offers a new service choice versus existing solutions from incumbent service providers. Additionally, FWA is suitable for both primary and backup internet service and can be deployed in locations where internet service may only be needed temporarily.”

Cable technology will lose market share over the next five years but will retain its dominant grip on the US fixed communications market, representing 58% of total broadband access lines in 2028. However, cable faces rising competition from 5G FWA networks deployed by mobile network operators as well as rollouts of new fiber-optic networks.

Parker adds:

“Fiber presents a significant challenge as it is highly reliable and can deliver the symmetrical multigigabit speeds that are increasingly demanded by consumers and businesses. Additionally, fiber deployment is gaining momentum as government subsidies lead to an unprecedented expansion of the nation’s fiber broadband infrastructure, leading this technology’s share of the market to grow from 19.5% in 2023 to 24.7% in 2028.”

Cable operators are upgrading their hybrid fiber/coax (HFC) networks with new DOCSIS 4.0 technology that is expected to support 10 Gbps downstream and up to 6 Gbps upstream capacity, which will help cable technology retain a dominant market share. However, some cable operators are starting to roll out their own fiber networks, particularly in ‘edge out’ situations where they expand their service footprints into nearby neighborhoods and communities, and this will also help boost fiber technology’s market share.

Parker concludes:

“Total US broadband services revenue is expected to increase at a compound annual growth rate (CAGR) of 4.2%, from $102.9 billion in 2023 to $126.3 billion in 2028. Service revenue for FWA will grow at a CAGR of 24.8% during the same period, while cable’s service revenue will rise at a 1.5% CAGR, and fiber’s will increase at a 9.1% CAGR.”