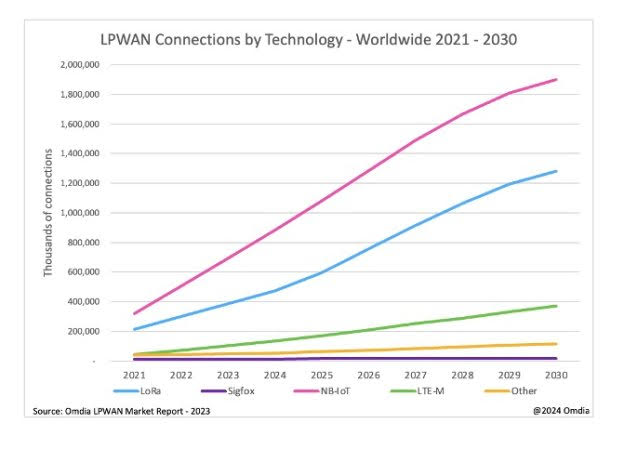

LONDON, June 19, 2024, THETECHMUSK=TTM: Omdia’s latest research has found that the Low Power Wide Area Network (LPWAN) IoT connections landscape is overwhelmingly dominated by NB-IoT and LoRa, which together accounted for 87% of the total connections in 2023. This dominance is set to continue, with these two technologies projected to maintain 86% of all LPWAN connections by 2030. While NB-IoT’s significant growth is driven by its popularity in China, LoRaWAN leads in most other regions. Both technologies are ideally suited for the mid-range IoT applications currently in demand, ensuring their sustained leadership in the LPWAN market. LoRa is expected to remain the preferred choice in private IoT connections, while NB-IoT will expand through cost-effective implementations, with both technologies poised for continued success through 2030.

Commenting on the growth of LPWAN connections, ShobhitSrivastava, Omdia Senior Principal Analyst stated, “Although NB-IoT is the leading LPWAN technology, over 90% of its connections are in China. Outside China, LoRaWAN remains the leading LPWAN connectivity technology due to years of unchallenged growth and momentum. LoRaWAN, with its alliance-driven approach, boasts a mature ecosystem that allows customers to choose from a range of partners and application-specific experts. Its future success is assured by its differentiated offerings. Newer LPWAN technologies like Wi-SUN and Mioty are also growing, following the successful alliance model that LoRa initially championed to develop an ecosystem.”

While LoRaWAN and NB-IoT may compete fiercely in today’s market (and through the forecast period), there is ample room for both protocols to be successful. LoRaWAN has now focused on high-growth areas, such as smart buildings, smart homes, and asset tracking.

Srivastava further noted, “NB-IoT will gain momentum in Europe after starting in 2023 as several service providers deploy satellite-based NB-IoT connectivity to address coverage gaps in remote areas. This, along with certain government regulations, will bolster NB-IoT growth in the region. By the end of 2023, China still accounted for nearly 90% of global NB-IoT connections. The Chinese government and the three national mobile operators continue to advocate for widespread NB-IoT adoption supported by Chinese chipset vendors. As Chinese vendors introduce affordable modules in Europe and South America, the technology will see further growth. NB-IoT use cases remain largely confined to stationary applications with the most popular being smart meters and utilities (water/gas/electricity) and connected spaces (smart cities).”